#Best app for receipts software

We've put together a list of the finest receipt scanners, receipt scanning apps, and software to organize your receipts.

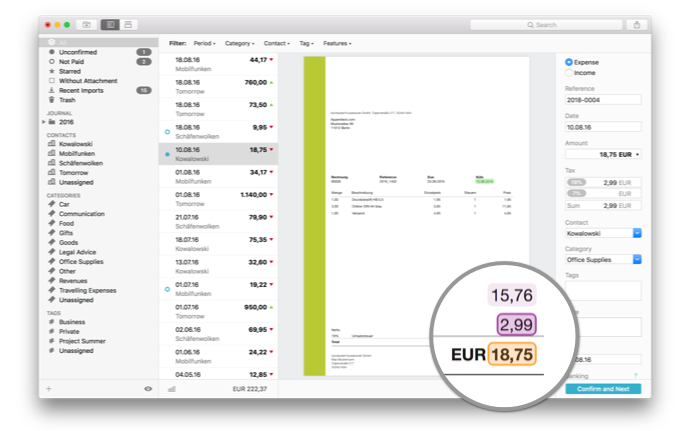

Now, let’s have a look at five of the best receipt-tracking apps out there. Physically saving your receipts in a cabinet or storage box exposes them and they may get damaged from wear and tear and natural disasters such as floods or fires. After all, you'll need to keep tax receipts for a long time in case you get audited. Digital saving for easier storageĭigitally saving your receipts saves you space and time trying to decipher damaged and faded receipts. OCR uses an algorithm that converts characters from printed sources into digital formats that allows them to be easily manipulated and edited.įor quick and easy creation and submission of expense reports, look for an app with Optical Character Recognition technology that automatically inputs data into an expense report by pulling it from a scanned receipt. Others even come with in-built scanners that make it easy to scan receipts, create and submit expense reports. Most of these mobile apps just need you to take pictures of receipts to scan them.

#Best app for receipts android

With everyone having some kind of mobile device- a mobile phone, tablet, or laptop- an app that can work on any device through mobile apps from either IOS or android app stores are ideal. The ability to dig deep into the receipt data is one of the biggest benefits of going digital for receipt expense tracking.Ī receipt scanning app is ideal for just such a situation as you can link all your expense data, invoices, and receipts to different categories, accounts, and projects. Other features include: Data categorization The best receipt app should be able to name, arrange and organize the receipts efficiently and quickly. While many tax receipt-scanners out there offer features that resonate with different business owners' values, it is a widely accepted fact that the software that can automate the receipt-tracking process is the preferred choice. Features of an ideal expense-tracking app You'll also get access to all our product suite for freelancers. Our app records your receipts and sends you notifications to file quarterly taxes as well as notify you of any filing deadlines.

If you want to track self-employed deductions and stay on top of all your taxes, try a 14-day test drive of Bonsai Tax. Note: On average, users save $5,600 from their tax bill by using our software. Let's take a closer look at what makes receipt tracking apps work for a freelancer. Receipt tracking apps are here to relieve you of that burden. Luckily for you, you no longer need to spend hours hoarding receipts and manually inputting business expenses into a spreadsheet. They can come in handy in the unfortunate case that the IRS decides to do a spontaneous tax audit of your receipts/returns. Receipts prove that your expenses are legitimate business costs and not fraudulent ones. This is because those expenses can be deducted when you file your annual taxes. However, saving and recording all your receipts are vital for a freelancer. Recording these 1099 tax deductions or business expenses can be time-consuming and tedious.

It is even tougher for freelancers because they have the extra responsibility of keeping track of all their expenses (meals, travel, entertainment, etc.), incomes, and receipts for taxes.

0 kommentar(er)

0 kommentar(er)